I had lunch with a friend recently who ran customer success for a SaaS company. Customer success in the SaaS business is typically responsible for handling customer support and service to build renewals when they come due while avoiding churn (customers who do not renew).

As we discussed the issues surrounding delivering a great customer experience and handling renewal sales, he commented that his biggest surprise was how much churn hurt his business. He noted that every percentage point increase in churn had a multiplier effect on the top line for the business.

I had lunch with a friend recently who ran customer success for a SaaS company. Customer success in the SaaS business is typically responsible for handling customer support and service to build renewals when they come due while avoiding churn (customers who do not renew).

I’d be repeating myself if I included a rant on how keeping customers coming back is the only way to realize the return you expect on your investment in customer acquisition. So instead, let’s talk about investing and how you can apply some very simple investment concepts to your marketing ROI.

Let’s talk bonds to demonstrate churn.

I know: bonds are much less exciting than stocks when it comes to investing, but if you’ve listened to any of the decent advice out there, you probably have a reasonable percentage of your portfolio invested in bonds.

Here’s the thing about bonds: they provide you with an income stream. You expect the issuer to pay the coupon on the bond (the debt payment) at the scheduled interval. The market places a value on the bond that is largely based on the dollar amount of those coupon payments, the time over which they will be paid, and the current market interest rates. If all goes well, you invest a lump sum and get paid back with interest over time.

Sometimes, all does not go well. I hope it’s rare for your portfolio, but defaults happen. Companies (sometimes even governments) fail to make the coupon payments. When this happens, you lose your money. Yes, it’s part of the risk of investing, but it also means your money is gone. Not exactly the outcome you wanted.

Connecting bonds, marketing, and churn.

Marketers have been talking about a concept called “customer lifetime value” for the past few years. Whether you are in a business that depends on subscribers or repeat customers, you can look at your customer the same way you look at a bond: you pay some amount up front (your acquisition cost), and you get a revenue stream that comes in at predictable intervals over time. As with the coupon payments on a bond, you can use the risk of the market and net present value formulas to determine the value of a customer’s revenue.

But sometimes customers don’t come back or don’t renew. The difference is that this happens at a much higher rate than bond defaults. For some SaaS software companies, churn (the rate of non-renewals) can be as high as 30% annually.

Let me show you what this does to your portfolio or your top line in marketing terms.

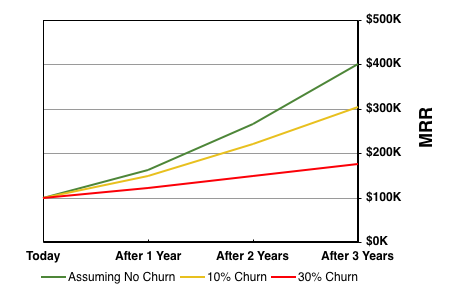

For the sake of simplicity and illustration, let’s assume you have 1,000 customers today, and those customers are paying you $100 per month for your service. Let’s also say you are a fast growing company, hitting growth rates of 50% annually. Here’s what churn (or customers not coming back) does to your business over three years.

On the chart above, the green line shows monthly recurring revenue (MRR) growth over three years, assuming there is no churn. The yellow line shows the same growth rate, but assumes 10% churn. The red line shows the same growth rate, but assumes 30% churn.

If you lose 30% of your customers every year for three years, your revenue is lowered by 56%.

If your portfolio underperformed by 56%, I’m guessing you’d be looking for a new investment adviser. Likewise, if your revenue is 56% below where it should be, I’m wondering if your CFO isn’t thinking about a new CMO.

I’ve been fortunate to work with many companies who understand the financial leverage keeping customers holds for your company. And I’ve helped a few gain insight into this leverage.

Which leads me to ask:

– Are you investing appropriately in keeping those customers?

– Does your company know how many customers it’s losing?

Tell us how you’re getting it right (or wish you were) in the comments.

4 thoughts on “Investing In Your Customers (and How to Avoid Churn)”

Maybe I am wrong, but it seems more companies are focused on new business versus churn. Is there any publicly available information on companies with low churn? (Most companies lie)

Craig: Great point, and it’s true that the industry in general is heavily focused on acquisition and far less so on retention.

The only information I know of right now are the case studies that Customer Success software vendors are publishing. There are some studies in the works and I hope they show the business case and where the appropriate level of investment might be for any given company.

One of the issues with the way churn is stated lies in the difference between “logo churn” (number of companies lost as customers) and “revenue churn” (dollar value of business lost), and the fact that upsell (increased value of customers who do renew) is added in, reducing the churn numbers in a way that masks retention issues. until we get an accounting standard which provides reporting that shows the true risks, we will understate churn and under-invest in retention.

Thanks for chiming in!

We’ve seen such a large push behind this idea of becoming more customer-focused companies, particularly from salesforce.com. Building out your Customer Success department is a must, and for those companies still behind the times, I really think your likening of poor customer retention and return to a poorly performing portfolio will wake people up. We’re losing out on opportunities to make more money? Now you have their attention.

Spot-on, Jeff — I would just add that those existing customers can’t only hear from you when it’s time to renew. You need to cultivate that relationship with regular touch points along the way and make sure they feel wanted and valued every single day — not just when their term is about to wrap up.